Financial Maths, STD2 F4 2015 HSC 29b

Jamal borrowed $350 000 to be repaid over 30 years, with monthly repayments of $1880. However, after 10 years he made a lump sum payment of $80 000. The monthly repayment remained unchanged. The graph shows the balances owing over the period of the loan.

Over the period of the loan, how much less did Jamal pay by making the lump sum payment? (2 marks)

--- 5 WORK AREA LINES (style=lined) ---

Financial Maths, STD2 F4 2010 HSC 28a

The table shows monthly home loan repayments with interest rate changes from February to October 2009.

- What is the change in monthly repayments on a $250 000 loan from February 2009 to April 2009? (1 mark)

--- 3 WORK AREA LINES (style=lined) ---

- Xiang wants to borrow $307 000 to buy a house.

Xiang’s bank approves loans for customers if their loan repayments are no more than 30% of their monthly gross salary.

Xiang’s monthly gross salary is $6500.

If she had applied for the loan in October 2009, would her bank have approved her loan?

Justify your answer with suitable calculations. (3 marks)

--- 6 WORK AREA LINES (style=lined) ---

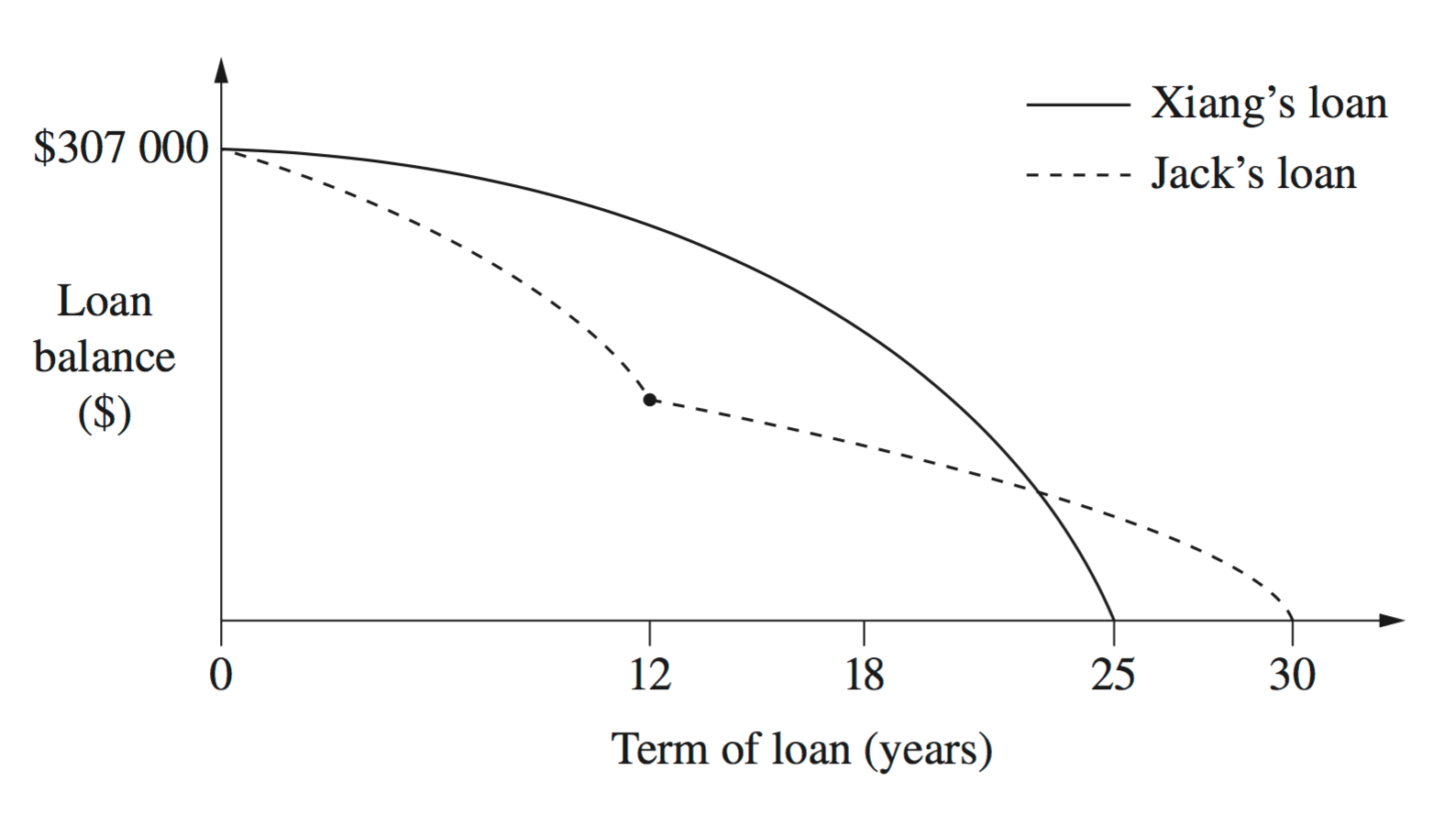

- Jack took out a loan at the same time and for the same amount as Xiang.

Graphs of their loan balances are shown.

Identify TWO differences between the graphs and provide a possible explanation for each difference, making reference to interest rates and/or loan repayments. (2 marks)

--- 5 WORK AREA LINES (style=lined) ---

Financial Maths, STD2 F4 2012 HSC 24 MC

A $400 000 loan can be repaid by making either monthly or fortnightly repayments.

The graph shows the loan balances over time using these two different methods of repayment.

The monthly repayment is $2796.86 and the fortnightly repayment is $1404.76.

What is the difference in the total interest paid using the two different methods of

repayment, to the nearest dollar?

- $51 596

- $166 823

- $210 000

- $234 936