Jack intends to deposit $80 into a savings account on the first day of each month for 24 months. The interest rate during this time is 6% per annum, compounded monthly.

- Calculate how much money Jack will have in his account at the end of the 24 months. (3 marks)

--- 10 WORK AREA LINES (style=lined) ---

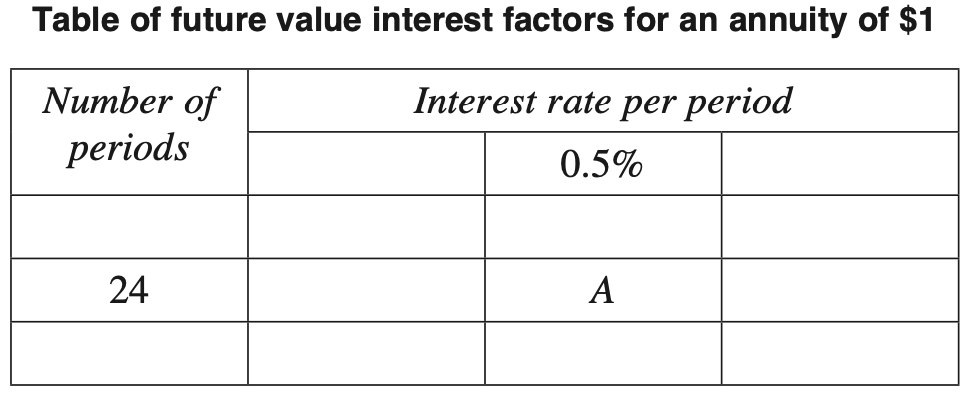

- A table of future value interest factors could have been used to calculate how much money Jack would have in his account at the end of the 24 months.

- Part of the table is shown.

- What is the value of \(A\) in the table? Give your answer correct to 3 decimal places. (1 mark)

--- 3 WORK AREA LINES (style=lined) ---