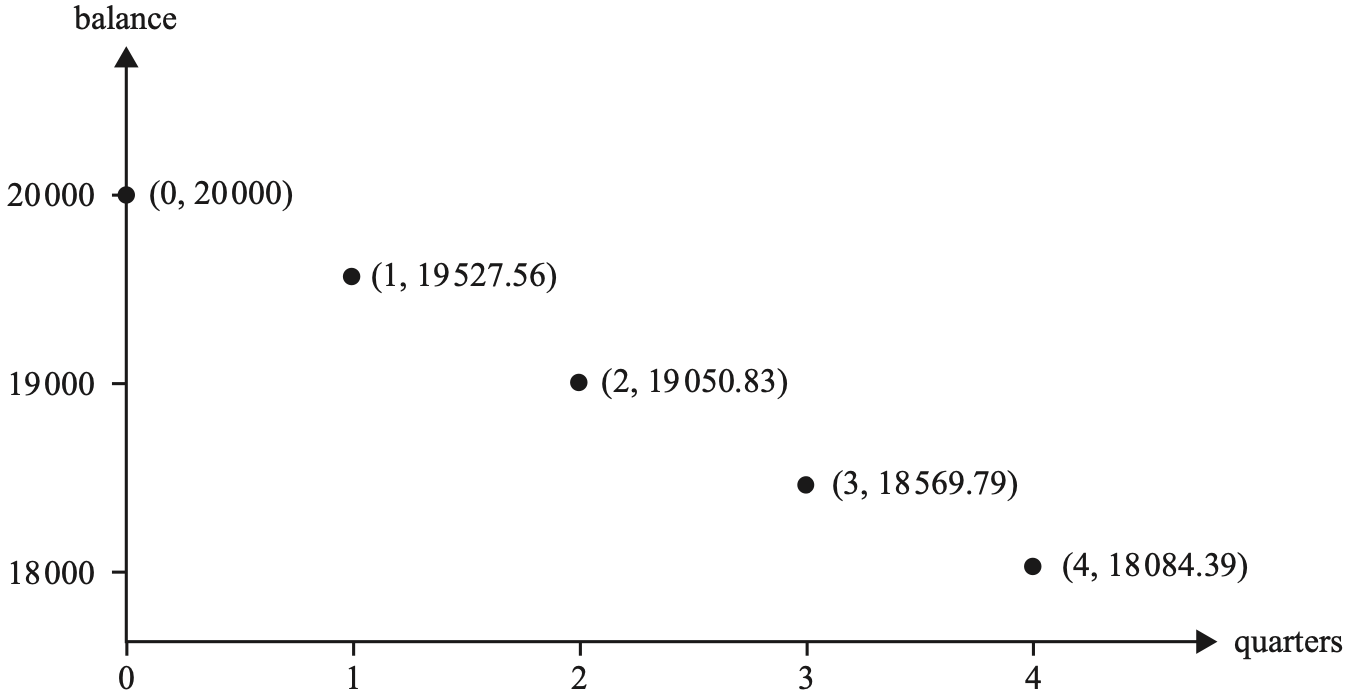

Tavi took out a loan of $20 000, with interest compounding quarterly. She makes quarterly repayments of $653.65.

The graph below represents the balance in dollars of Tavi's loan at the end of each quarter of the first year of the loan.

The effective interest rate for the first year of Tavi's loan is closest to

- 3.62%

- 3.65%

- 3.66%

- 3.67%

- 3.68%