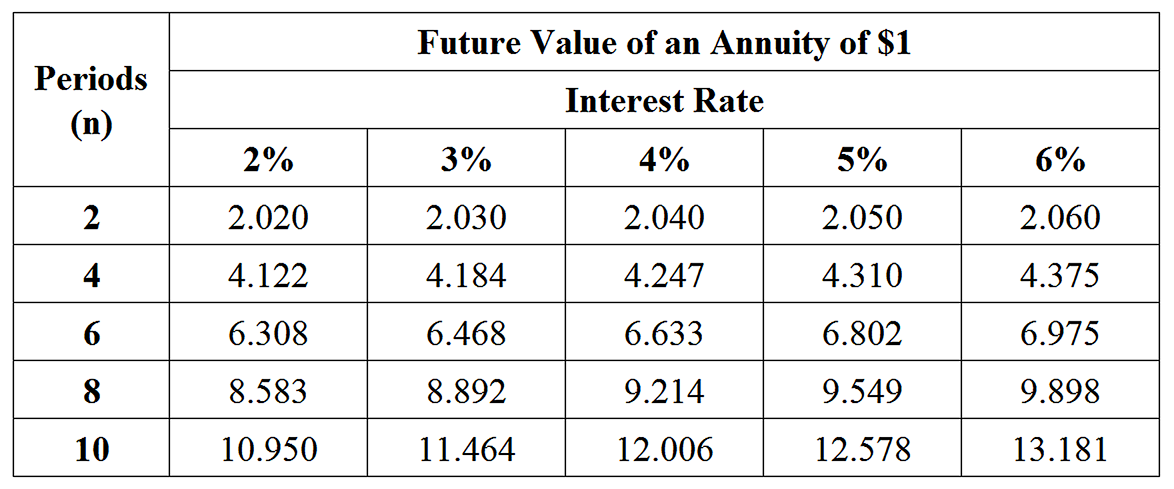

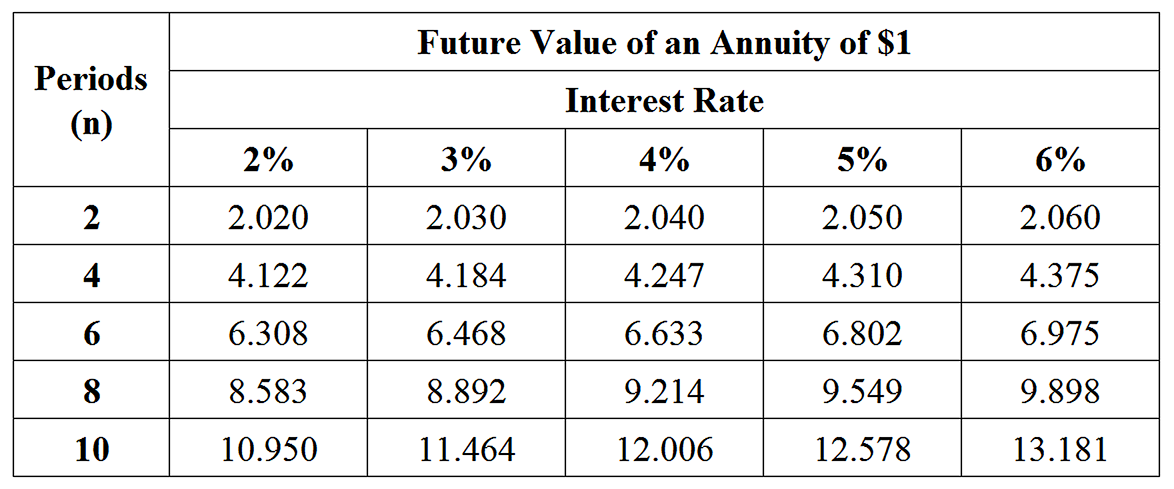

A table of future value interest factors for an annuity of $1 is shown.

The prize in a lottery is an annuity of $5000 a year for 10 years, invested at 4.5% per annum compounding annually.

What will be the value of the prize at the end of 10 years? (2 marks)

--- 4 WORK AREA LINES (style=lined) ---