Twenty-five years ago, Phoenix deposited a single sum of money into a new bank account, earning 2.4% interest per annum compounding monthly.

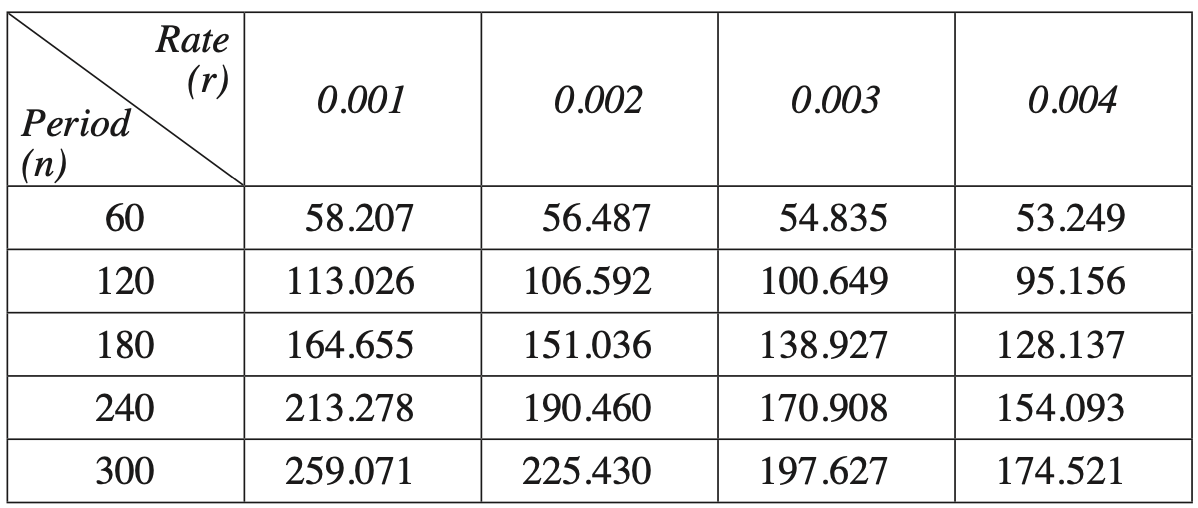

Present value interest factors for an annuity of $1 for various interest rates \((r)\) and numbers of periods \((n)\) are given in the table.

Phoenix made the following withdrawals from this account.

- $2000 at the end of each month for the first 15 years, starting at the end of the first month.

- $1200 at the end of each month for the next 10 years, starting at the end of the 181st month after the account was opened.

Calculate the minimum sum that Phoenix could have deposited in order to make these withdrawals. (4 marks)

--- 10 WORK AREA LINES (style=lined) ---