A used car is for sale at $19 500. Priya purchases it using a finance package with a 15% deposit and weekly repayments of $143.27 for 3 years.

What is the interest Priya will pay? (3 marks)

--- 6 WORK AREA LINES (style=lined) ---

Aussie Maths & Science Teachers: Save your time with SmarterEd

A used car is for sale at $19 500. Priya purchases it using a finance package with a 15% deposit and weekly repayments of $143.27 for 3 years.

What is the interest Priya will pay? (3 marks)

--- 6 WORK AREA LINES (style=lined) ---

\($5775.12\)

| \(\text{Deposit}\) | \(=\dfrac{15}{100}\times 19\,500=$2925\) |

\(\text{Weeks in 3 years}=3\times 52=156\)

| \(\text{Total repayments}\) | \(=156\times 143.27\) |

| \(=$22\,350.12\) |

| \(\text{Total cost}\) | \(=2925+22\,350.12\) |

| \(=$25\,275.12\) |

| \(\therefore\ \text{Interest paid}\) | \(=25\,275.12-19\,500\) |

| \(=$5775.12\) |

A smart TV is for sale at $2850. Liam purchases it using a finance package with a 20% deposit and monthly repayments of $87.63 for 3 years.

What is the interest Liam will pay? (3 marks)

--- 6 WORK AREA LINES (style=lined) ---

\($874.68\)

\(\text{Deposit}=\dfrac{20}{100}\times 2850=$570\)

\(\text{Months in 3 years}=3\times 12=36\)

\(\text{Total repayments}=36\times 87.63=$3154.68\)

\(\text{Total cost}=570+3154.68=$3724.68\)

\(\therefore\ \text{Interest paid}=3724.68-2850=$874.68\)

Mei is purchasing a new car and has a choice between two finance packages.

Package A: Deposit of $5000, monthly repayments of $1150 for 4 years.

Package B: No deposit, monthly repayments of $1280 for 5 years.

--- 2 WORK AREA LINES (style=lined) ---

--- 2 WORK AREA LINES (style=lined) ---

--- 2 WORK AREA LINES (style=lined) ---

a. \($60\,200\)

b. \($76\,800\)

c. \($16\,600\)

a. \(\text{Total repayments} (A)=1150\times 12\times 4=$55\,200\)

\(\text{Total cost of Package A}=5000+55\,200=$60\,200\)

b. \(\text{Total repayments (B)}=1280\times 12\times 5=$76\,800\)

\(\text{Total cost of Package B}=$76\,800\ \text{(No deposit)}\)

c. \(\text{Savings using Package A}=76\,800-60\,200=$16\,600\)

A motorcycle is for sale at $16 500. Finance is available with a $3200 deposit and monthly repayments of $420 for 3 years.

--- 2 WORK AREA LINES (style=lined) ---

--- 3 WORK AREA LINES (style=lined) ---

--- 2 WORK AREA LINES (style=lined) ---

a. \($15\,120\)

b. \($18\,320\)

c. \($1820\)

a. \(\text{Number of months}=3\times 12=36\ \text{months}\)

\(\text{Total repayments}=36\times 420=$15\,120\)

| b. | \(\text{Total cost}\) | \(=\text{Deposit}+\text{Total repayments}\) |

| \(=$3200+$15\,120\) | ||

| \(=$18\,320\) |

| c. | \(\text{Interest paid}\) | \(=\text{Total cost}-\text{Original cost}\) |

| \(=$18\,320-$16\,500=$1820\) |

Rachel is purchasing a new refrigerator priced at $3200. The store offers finance terms of 30% deposit and repayments of $65 per week for 40 weeks.

--- 2 WORK AREA LINES (style=lined) ---

--- 2 WORK AREA LINES (style=lined) ---

--- 2 WORK AREA LINES (style=lined) ---

a. \($960\)

b. \($2600\)

c. \($3560\)

a. \(\text{Deposit}=\dfrac{30}{100}\times 3200=$960\)

b. \(\text{Total repayments}=65\times 40=$2600\)

| c. | \(\text{Total cost}\) | \(=\text{Deposit}+\text{Total repayments}\) |

| \(=$960+$2600\) | ||

| \(=$3560\) |

Ben is purchasing a used van with a sale price of $32 600. He has arranged finance with weekly repayments of $280 for 3 years.

Calculate the total amount of the repayments. (2 marks)

--- 3 WORK AREA LINES (style=lined) ---

\($43\,680\)

\(\text{Number of weeks in 3 years}=3\times 52=156\ \text{weeks}\)

\(\text{Total repayments}=280\times 156=$43\,680\)

Olivia is purchasing a car with a sale price of $24 800. She needs to pay a 25% deposit. Calculate the amount of the deposit Olivia needs to pay. (1 mark)

--- 2 WORK AREA LINES (style=lined) ---

\($6200\)

\(\text{Deposit}=\dfrac{25}{100}\times 24\,800=$6200\)

Tom purchased a car using a finance package. He paid a deposit of $6500 and the total amount he paid for the car was $38 900. The loan was for 4 years with equal monthly repayments.

What was Tom's monthly repayment?

\(A\)

| \(\text{Total repayments:}\) | \(=\text{Total amount paid}-\text{Deposit}\) |

| \(=38\,900-6500\) | |

| \(=$32\,400\) |

\(\text{Number of repayments}=4\times 12=48\)

\(\text{Monthly repayment:}=\dfrac{32\,400}{48}=$675\ \text{per month}\)

\(\Rightarrow A\)

Jessica is purchasing a van for sale at $32 000. Finance is available with a 15% deposit and monthly repayments of $720 for 4 years.

What is the total cost of purchasing the van using the finance package?

\(C\)

\(\text{Calculate deposit:}\)

\(\text{Deposit}=\dfrac{15}{100}\times $32\,000=$4800\)

\(\text{Calculate total repayments:}\)

\(\text{Total repayments}=720\times 12\times 4=$34\,560\)

| \(\text{Total cost:}\) | \(=\text{Deposit}+\text{Total repayments}\) |

| \(=4800+34\,560\) | |

| \(=$39\,360\) |

\(\Rightarrow C\)

David is purchasing a motorcycle for sale at $15 600. The finance terms are weekly repayments of $180 for 2 years.

What is the total amount of the repayments?

\(C\)

\(\text{Number of weeks in 2 years:}=2\times 52=104\)

| \(\text{Total repayments}\) | \(=104\times $180\) |

| \(=$18\,720\) |

\(\Rightarrow C\)

Sarah is purchasing a car for sale at $28 000. She must pay a 20% deposit.

What is the amount of the deposit Sarah needs to pay?

\(B\)

| \(\text{Deposit}\) | \(=20\%\times $28\,000\) |

| \(=$5600\) |

\(\Rightarrow B\)

A car is for sale at $18 000. Finance is available at $4000 deposit and monthly repayments of $380 for 5 years. What is the interest paid on the loan?

\(B\)

\(\text{Deposit} =$4000\)

\(\text{Monthly repayments} =$380\times 12\times 5 =$22\,800\)

\(\text{Total paid} =4000+22\,800= \$26\,800\)

\(\text{Interest paid}=26\,800-18\,000=$8800\)

\(\Rightarrow B\)

Ian works in a packaging factory and is paid $0.85 for each box he packs. Last month he worked 160 hours and packed 8960 boxes.

--- 2 WORK AREA LINES (style=lined) ---

--- 5 WORK AREA LINES (style=lined) ---

a. \($7616\)

b. \(\text{6.5% decrease}\)

a. \(\text{Total Earnings}=0.85\times 8960=$7616\)

b. \(\text{Hourly rate (last month)}=\dfrac{7616}{160}=$47.60\)

\(\text{New hourly wage} = $44.50\ \text{(given)}\)

\(\text{% decrease}=\dfrac{47.60-44.50}{47.60}=0.0651… = 6.5\%\ \text{decrease}\)

\(\therefore\ \text{Ian’s hourly rate has decreased 6.5%.}\)

Jacinta buys several items at the supermarket. The docket for her purchases is shown below.

What is the amount of GST included in the total?

\(A\)

\(\text{Total price of taxable items}\ +\ 10\%\ \text{ GST}\ =1.29+7.23+4.13=$12.65\)

| \(\therefore\ 110\%\ \text{of original price}\) | \(=$12.65\) |

| \(\therefore\ \text{GST}\) | \(=$12.65\times\dfrac{100}{110}\) |

| \(=$1.15\) |

\(\Rightarrow A\)

The cost of a plumbing job is $500 plus 10% GST.

What is the total cost of the job, including GST?

\(D\)

| \(\text{Total Cost}\) | \(=500+0.10\times 500\) |

| \(=500+50\) | |

| \(=$550\) |

\(\Rightarrow D\)

A bill for servicing a car is made up of:

The mechanic needs to add 10% GST onto the labour charge.

How much GST does the customer pay in total?

\(C\)

\(\text {Let}\ \ X=\text{ parts cost ex-GST}\)

| \(X+X \times 0.1\) | \(=242\) | |

| \(1.1X\) | \(=242\) | |

| \(X\) | \(=220\) |

\(\text{Total GST}=0.1(220+100)=\$ 32.00\)

\(\Rightarrow C\)

A receipt from a supermarket shows a total of $124.87. The GST shown on the receipt is $3.86. GST, at a rate of 10%, is only charged on some items. What was the value of the items which did NOT have GST charged? (3 marks) `$82.41` `text{Let}\ X=\ text{cost of goods that attract GST (before GST added)}`

`10% xx X`

`=3.86`

`X`

`=$38.60\ \ text{(before GST added)}`

`text{Items with no GST}`

`=124.87-38.60-3.86`

`=$82.41`

An item is discounted by 30% and then a further discount of 20% is applied to the reduced price.

What is the total percentage discount?

`=>B`

`text{Method 1}`

`text{Let original price}\ =x`

`text{1st discount}\ =0.7x`

`text{2nd discount}\ = 0.7x xx 0.8=0.56x`

`text{Total discount}\ = 1-0.56=0.44`

`text{Method 2}`

`text{$100 less 30% = $70}`

`text{$70 less 20%} = 70-0.2xx70=$56`

`text{Total discount $100 ↓ $56 = 44%}`

`=>B`

An item was purchased for a price of $880, including 10% GST.

What is the amount of GST included in the price?

`=>C`

`text{Let}\ C =\ text{Original cost}`

| `C+0.1 xx C` | `=880` | |

| `1.1C` | `=880` | |

| `C` | `=880/1.1` | |

| `=$800` |

`:.\ text{GST}\ =800xx0.1=$80`

`=>C`

Part of a supermarket receipt is shown.

Determine the missing values, `A` and `B`, to complete the receipt. (2 marks)

--- 4 WORK AREA LINES (style=lined) ---

`$9.00`

`text(Chocolate is the only item where GST applies.)`

`text(GST on chocolate = 0.70`

`=> text(C)text(ost of chocolate) = $7.00`

`:. A = 7.00 + 0.70 = $7.70`

| `:. B` | `= 36.25 – (7.70 + 5.00 + 8.50 + 3.20 + 2.85)` |

| `= $9.00` |

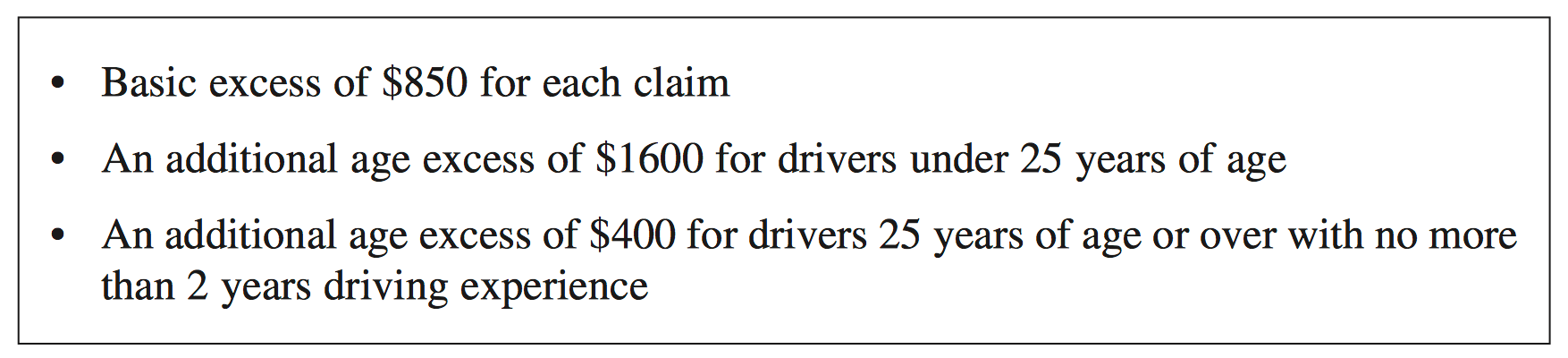

Mary is 18 years old and has just purchased comprehensive motor vehicle insurance. The following excesses apply to claims for at-fault motor vehicle accidents.

How much would Mary be required to pay as excess if she made a claim as the driver at fault in a car accident?

`C`

`text(Mary’s excess = 850 + 1600)`

`text{($400 does not apply as Mary is under 25.)}`

`=> C`

Sam is the driver at fault in a car accident.

Which of the following is covered by Sam's compulsory third-party (CTP) insurance?

`B`

`text(CTP insurance covers liability for death or injury)`

`text(to other people, but does not cover property damage.)`

`=>B`

To determine the retail price of an item, a shop owner increases its cost price by 30%. In a sale, the retails price is reduced by 30% to give the sale price.

How does the sale price compare to the cost price?

`text(A)`

`text{Take an item that costs $100 (for example):}`

`=>\ text(Original price) = 100 xx 1.3 = $130`

`=>\ text(Sale Price) = 130 xx 0.7 = $91`

`:.\ text(Sale price < cost price)`

`=>\ text(A)`

Alex is buying a used car which has a sale price of $13 380. In addition to the sale price there are the following costs:

--- 1 WORK AREA LINES (style=lined) ---

The cost of comprehensive insurance is calculated using the following:

Find the total amount that Alex will need to pay for comprehensive insurance. (3 marks)

--- 6 WORK AREA LINES (style=lined) ---

What extra cover is provided by the comprehensive car insurance? (1 mark)

--- 2 WORK AREA LINES (style=lined) ---

a. `$402`

b. `$985.74`

c. `text(Comprehensive insurance also covers Alex for damage to his own car.)`

a. `($13\ 380)/100 = 133.8`

`text(Stamp duty)= 134 xx $3= $402`

b. `text(Base rate)= $845`

`text(FSL) =\ text(1%) xx 845 = $8.45`

| `text(Stamp)` | `=\ text(5.5%) xx(845 + 8.45)` |

| `= 46.9397…` | |

| `= $46.94\ text{(nearest cent)}` |

`text(GST)= 10 text(%) xx(845 + 8.45)= 85.345= $85.35`

| `:.\ text(Total cost)` | `= 845 + 8.45 + 46.94 + 85.35` |

| `= $985.74` |

c. `text(Comprehensive insurance covers Alex for damage done)`

`text{to his own car as well.}`

A dress was on sale with 25% discount.

As a regular customer, Kate received a further 10% on the already discounted price.

What was the overall percentage discount Kate received? (2 marks)

--- 5 WORK AREA LINES (style=lined) ---

`text(32.5%)`

`text{Solution 1 (efficient method)}`

| `text(Overall discount)` | `=1-(0.75 xx 0.90)` |

| `=1-0.675` | |

| `=0.325` | |

| `=32.5text(%)` |

`text(Solution 2)`

`text(Let the dress cost) = $100`

`text{Cost after 25% discount} = $75`

`text(C) text(ost after another 10% discount)= 75-(10 text{%} xx 75)= $67.50`

`:.\ text(Overall discount) = (100-67.50)/100=32.5text(%)`

A golf shop is having a Boxing Day sale.

--- 3 WORK AREA LINES (style=lined) ---

--- 2 WORK AREA LINES (style=lined) ---

--- 2 WORK AREA LINES (style=lined) ---

a. `15 text(%)`

b. `$3.75`

c. `$136.00`

a. `text(Percentage Discount)=(120-102)/120 xx 100=15 text(%)`

b. `text(Discounted Amount)=15 text(%) xx 25=$3.75`

c. `text(Sale Price)= 160-15 text(%) xx 160=0.85 xx 160=$136.00`

Ralph buys a utility vehicle with a market value of $63 500.

Stamp duty is calculated on the vehicle as follows:

Calculate the amount of stamp duty payable by Ralph. (2 marks)

`$2275`

| `text(Stamp Duty)` | `= 3text(%) xx 45\ 000 + 5text(%) xx (63\ 500-45\ 000)` |

| `= 3text(%) xx 45\ 000 + 5text(%) xx 18\ 500` | |

| `= $2275` |

Alice intends to buy a car and insure it.

Briefly describe what each of these types of insurance covers:

• Compulsory third-party insurance (CTP)

• Non-compulsory third-party property insurance. (2 marks)

--- 4 WORK AREA LINES (style=lined) ---

`text(CTP Insurance:)`

`text(This insures a driver against liability)`

`text(if their car injures or kills a person)`

`text(in an accident.)`

`text(Non-compulsory TP Insurance:)`

`text(This insurance covers damage to)`

`text(other people’s property in an accident,)`

`text(but does not cover the driver’s own vehicle.)`

`text(CTP Insurance:)`

`text(This insures a driver against liability)`

`text(if their car injures or kills a person)`

`text(in an accident.)`

`text(Non-compulsory TP Insurance:)`

`text(This insurance covers damage to)`

`text(other people’s property in an accident,)`

`text(but does not cover the driver’s own vehicle.)`

An insurance company offers customers the following discounts on the basic annual premium for car insurance.

If a customer is eligible for more than one discount, subsequent discounts are applied to the already discounted premium. The combined compulsory third party (CTP) and comprehensive insurance discount is always applied last.

Jamie has three insurance policies, including combined CTP and comprehensive insurance, with this company. He has used this company for 8 years and he has never made a claim.

The basic annual premium for his car insurance is $870.

How much will Jamie need to pay after the discounts are applied?

`C`

`text(Multi-policy discount)`

| `text(New premium)` | `= 870 − (text(15%) xx 870)` |

| `= $739.50` |

`text(No claim bonus)`

| `text(New premium)` | `= 739.50 − (text(20%) xx 739.50)` |

| `= $591.60` |

`text(Combined CTP bonus)`

| `text(New premium)` | `= 591.60 − 50` |

| `= $541.60` |

`⇒ C`

A camera costs $449, including 12% GST.

What is the price of the camera without GST, correct to the nearest dollar?

`B`

`text(Let)\ C\ text(= cost of camera ex-GST)`

| `C + text(12%)C` | `= $449` |

| `1.12C` | `= 449` |

| `:. C` | `= 449/1.12` |

| `= $400.89…` |

`⇒ B`

Rita purchased a camera for $880 while on holidays in Australia. This price included 10% GST. When she left Australia she received a refund of the GST.

What was Rita’s refund?

`A`

`text(Let)\ C = text(cost before GST)`

| `880` | `= C + text(10%) C` |

| `1.1C` | `= 880` |

| `C` | `= $800` |

| `:.\ text(GST)` | `=10 text(%) xx 800` |

| `= $80` |

`=> A`

The price of a CD is $22.00, which includes 10% GST.

What is the amount of GST included in this price?

`A`

`text(CD costs $22.00 incl. GST`

`text(Let)\ C = text(original cost)`

| `C + text(10%) xx C` | `= 22` |

| `1.1C` | `= 22` |

| `C` | `= 20` |

| `:.\ text(GST)` | `= 22.00 – 20.00` |

| `= $2.00` |

`=> A`

The average NSW annual water consumption from the residential sector is equal to 90 340 litres per person per year. The Building Sustainability Index (BASIX) uses this as the benchmark to set a target for reducing water consumption by up to 40%.

A new building, planned to house 50 people, has been designed to meet a 25% reduction on this water consumption benchmark.

How much water per year, to the nearest kilolitre, is this building designed to save when fully occupied?

`A`

`text(Benchmark) = 90\ 340\ text(L)`

`text(Water saved if usage)\ darr text(25%)`

`= 90\ 340 xx text(25%)`

`= 22\ 585\ text(L per person)`

`:.\ text(Water saved for 50 people)`

`= 50 xx 22\ 585`

`= 1\ 129\ 250\ text(L)`

`~~ 1129\ text(kL)`

`=> A`

A new phone was purchase for $725 which included 10% GST.

What was the price of the phone without GST, correct to the nearest cent?

`D`

| `text(Price phone)\ +\ text(10% GST)` | `=725` |

| `text(110%)\ xx\ text(Phone price)` | `=725` |

| `:.\ text(Phone price)` | `=725/1.1` |

| `=$659.09` |

`=> D`